Posabit: An Asymmetric Bet In The Cannabis Payment Solutions And POS Space.

Price(USD): $0.56 , FDSO: ~165m, Market Cap: $92m, Net Debt: -$8m, TEV: $84m

Posabit Systems Corp (OTC: POSAF) is a compelling long at current prices with 50-200% upside over the next 6-18 months and potentially sooner given the current sentiment for cannabis banking regulation. After the optimism expressed on their Q3 call this past week, I believe a write-up is deserving.

Introduction

I first heard the idea from Jeremy Raper on Seeking Alpha about a year ago. I advise reading his write-up first to gain a better understanding of the company. Since then, the set up has arguably improved though the stock has been cut in half. I believe another look is warranted after a strong turnout by democrats in the senate and a strong Q3. Posabit Systems Corp is a niche payment solution provider for typically cash only businesses. Many are familiar with Clover, Square, or Toast which are all POS, or point-of-sale, systems responsible for processing transactions between a customer and business. The difference is, Posabit has a competitive advantage in compliance, making them the first debit solution in the cannabis industry. Incorporated less than eight years ago and raising only $11m, the company already has run rate revenue surpassing $40m and is publicly traded on the CSE. The company has shown remarkable financial performance since inception yet the stock continues to fall along with the cannabis sector. As a result, the market is giving us the chance to buy a superior business at a severely discounted price.

The Business

There is strict regulation surrounding the medical and recreational marijuana industry. When it comes to payments, U.S banks aren't allowed to offer their services as they would to a traditional vender. Because marijuana is federally illegal, dispensaries are forced to implement payment systems which are an annoyance to customers and inconvenient for budtenders. As a result, most dispensaries in the U.S are still cash only, explaining why Posabit’s biggest competitor is still the ATM. The industry’s most common solution is PoB(Point of Banking). Similar to how an ATM works, if you walk into a dispensary and purchase an item for $33 with a debit card, it will be rounded up to $40, you will have to pay the $2-$3 ATM fee (on top of the state marijuana tax) then get your change back. This is the most expensive payment solution for consumers because dispensaries just increase prices to cover their transaction fee. In 2015, founder and CEO Ryan Hamlin designed a fully compliant way to process transactions securely, safely, and conveniently. On top of PoB, Posabit generates revenue from Debit to the Penny (which allows exact change back like most stores) and traditional ACH. Aside from banking, the company charges a monthly subscription for its POS terminals and receives SaaS like revenue. Hamlin predicts SaaS will represent 20% of revenue in the next 2-3 years while transaction fees from their banking services will represent the other 80%.

Financials

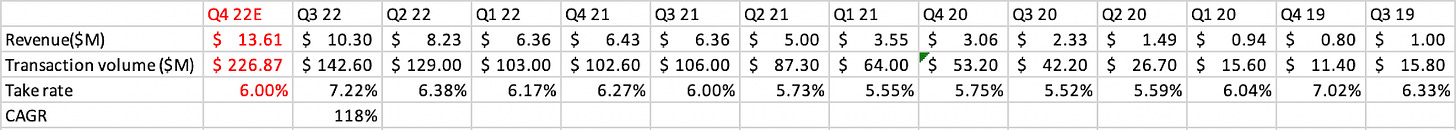

- Revenue. 125% revenue CAGR from 2017 to 2022 is pretty impressive. Firms with this rate of growth aren't typically EBITDA positive as SG&A eats away at profits. The company averages a 6% take rate on a transaction volume run rate exceeding half a billion per annum. The U.S legal cannabis market is expected to grow from $27b in 2022 to $42b in 2026. I look at the legal market growth rate as a floor for Posabit’s CAGR over the next 3-4 years. They also receive a monthly fee averaging $225 per POS device. With around five devices per dispensary, Posabit generates about $1,000 in SaaS revenue per store per month. To date they are in 500+ dispos of the 9500 in the U.S (~5% market share). Some simple math suggests they are currently run rating somewhere in the $6m range in SaaS revenue, or around 15% of total revenue. Posabit’s transaction volume currently accounts for just 30% of the total sales generated from their merchants. Revenue increases not only when MSOs(multi-state operators) open new locations, but also when Posabit’s transaction volume increases as a percentage of total merchant sales. Also worth noting on their Q3 call, Hamlin said same store transaction volume should triple once SAFE banking is passed and IF Visa and Mastercard accept payments. My valuation does not include this scenario but I believe there's a ~20% probability this happens by year end 2024.

- Margins. The company hasn't reported a profit since Q1 21 but intends to be EBITDA profitable in FY23. Q2 22 opex was $5.9m, in Q3 it was $2.9m meanwhile revenue grew 22% QoQ. I believe they have hit the inflection point and skepticism regarding the profitable nature of the business should fade into 2023. Hamlin said in an investor conference he sees gross margins exceeding 40% in the near term–not sure when this is exactly. The average matured payment processor has a 36% EBITDA margin. If their POS takes off and exceeds the 20% of revenue Hamlin predicts, margins will be even higher considering SaaS margins are somewhere in the 60-70% range.

In August, Posabit signed a licensing deal with a “large cannabis technology partner” where they receive a minimum of $20m in royalties over 4 years and a maximum of $30.75min return for their payment technology at 100% margins(I assume this partner is Dutchie, a leader in the cannabis POS space). I value this deal alone at $15m or $0.18/share– without consideration for a renewal once the 4 years are up. Obviously if the deal is renewed, this is worth more.

Valuation

At an enterprise value of $84m, Posabit trades just 2x revenue. I believe the best way to look at this is through a SOTP. Breaking out the revenue from their debit solution, PoS, and licensing agreement, I arrive at $1.29/share with conservative assumptions. Keep in mind, the average EV/revenue multiple for SaaS businesses (with an average growth rate of 25%) is ~8x. Posabit’s should be far higher with 125% growth. I’m using 4x just to highlight the absurdity of the valuation.

Another method is to discount the future EV. Using conservative revenue and margins assumptions, calculating a fair value well above the current price again isn't hard. The company almost doubled revenue every year for the past four years. I’m estimating a 30% CAGR from FY22 to FY26 and a 2026 EBITDA margin of 25%(<25% discount to comps). At a 10x EV/EBITDA, the equity is worth $275m in 2026. Discounted back at 6% the equity should be worth $215m today or $1.35. In the bull case, revenue grows 50% yoy with 30% EBITDA margins. At 12x, the stock is worth $3.30, suggesting room for stratospheric returns should they surprise any further to the upside.

If we compare sales multiples in the payment processing space, Posabit still trades at an enormous discount despite having the highest revenue growth. In his Seeking Alpha article, Jeremy Raper calculated the correlation coefficient between forward revenue growth and EV/Sales to be 92% R2. If Posabit were to trade in line with the industry, the stock would be worth around $1.25(and it shouldn’t because its growth is much higher). If we assume 25% of revenue is SaaS generated, the multiple will obviously increase. If 25% of Posabit’s revenue is valued at just 15x, a 6x multiple seems fair, or $1.50/share.

Further Upside

In a November 22nd interview, Hamlin said he’s planning to focus on two new initiatives in the coming quarters. First, he wants to “meet the needs of the entire supply chain”. From cultivator to manufacturer to customer, there is a good chance Posabit is first in line once the easing of regulation begins. With the moat they’ve built around compliance, Posabit can easily be a frontrunner in the cannabis B2B payment space. Second, Hamlin wants to use data collection and analytics to create a self service kiosk. Not only will this be convenient for customers and dispensary owners, Posabit can also leverage this information by selling it through the supply chain. If the revenue from these channels is recognized concurrently with an uplisting, I believe all my assumptions are too low.

As I mentioned above, if SAFE passes and Visa and Mastercard accept payments, transaction volume will triple instantly. If they are EBITDA positive going into FY23, this could theoretically drop straight to the bottom line after cogs, since opex won’t need to increase to support the revenue growth. The question comes down to whether MA and V want to harm their reputations by entering the industry. My take is if they can transact with pornography companies, which they do, they can transact with dispensaries once marijuana is decriminalized.

Why Now?

- The failure of the “red wave” this past November. Probability of favorable legislation passing in short order has increased, yet stock is flat. SAFE Banking Plus, the bill intended to prohibit federal regulators from penalizing a depository institution for providing banking services to cannabis-related businesses, could be a priority during lame duck session in the following months. There’s been discussion around the inclusion of the CLIMB act (Capital Lending in Marijuana Business) in SAFE Banking Plus. I don't think it’s likely but the probability isn't 0 and, if anything, increased after the election. The act explicitly allows cannabis companies to uplist to the major U.S exchanges. This will be an immediate catalyst for all cannabis stocks.

- FY23 the company intends to be EBITDA profitable. They reported positive EBITDA once, in Q1 21, proving the business is naturally capable of turning a profit even at the current growth rate. Many of the MSOs they partnered with in FY22 received one-time discounts. These should fade in the coming quarters and reflect a more accurate ARR and profit margin. Once they’re in the green, funds which only invest in profitable businesses will take a second look and reconsider Posabit’s investability.

- Legalization in Maryland and Missouri post Nov 8th. The cannabis sales growth rate in both markets is double Washington, Colorado, and Nevada’s, where Posabit is most present. The company has always been quick to enter new markets and is eager to partner with larger MSOs, which are generally sticker, more reliable customers. The company plans to be live in 24 states by year end but is currently in only 21. Within the next 1-3 months I’m optimistic they’ll release the remaining 3 states.

- Private comps are higher than public comps. This has been the trend for the past few years and benefits companies like Posabit who, if unable to uplist to a larger exchange, will likely go private to get the respect they deserve. To put things into perspective, in 2021, Dutchie, another cannabis fintech company, raised $200m at a $1.7B valuation or 25x ARR. If just POS SaaS revenue was valued at 25x, it's worth $150m alone.

What the market is missing/why it’s cheap

The Company went public through an RTO thus was unable to effectively advertise its equity in a roadshow. In an investor conference, Hamlin said he regretted the misguided decision to go public on the CSE. The CSE has a market capitalization of $35.4 billion compared to the Nasdaq and NYSE with $19.4 trillion and $24.1 trillion respectively. To make things worse, last year management made poor investments in their investor relations leading to zero analyst coverage and zero questions on their earnings call. They've begun picking up the pace recently. Over the past few quarters they have questions on their calls but still no coverage I could find. The stock has ~25% insider ownership and maybe one or two institutional investors.

The Cannabis sector in general has been ugly ytd. MSOS, the largest cannabis ETF, is down almost double the Nasdaq. Many firms in the space are experiencing layoffs and lowering guidance. This isn't the case for Posabit. Hamlin said had there been no downturn in the market, revenue would be “significantly” higher. To me, this sounds like they’d easily be doing $50m+ run rate mid-cycle.

Risks

The biggest risk as far as I can tell is the stock’s volume. In a world where no legislation passes, Posabit can continue to trade at these depressed multiples until the sector finally becomes investable. Till then, capital may be better spent elsewhere and the stock will continue to trade less than $30,000/ day. I don’t believe this will be the outcome because Hamlin has proven he cares for shareholders and indeed has a lot of skin in the game. More likely, they go private at a sensical valuation far higher than where they are today. The other risk is competition. In the PoB space, their biggest competition is cash, all other payment processing technology is outdated or expensive. In the POS space, it's a bit more congested. Hamlin claimed they were somewhere around 6th although, in the recent quarter, there was commentary about many of the smaller players falling off because of the current macro environment. Based on his confidence in the call, I’d put them closer to the 4-5 spot now. Regardless, their payments technology seems to still be superior, evident by the licensing deal they signed this year with likely one of the larger, top 1 or 2 players.

One concern Raper discusses in his write-up is the possibility of larger players intruding the space once regulation eases. There's an outcome where Square, and Clover type players takeover and eventually drive out companies like Posabit, just as a luxury of having scale. I believe the more likely scenario is an acquisition. The payment processing business is extremely sticky. Dispensaries can’t simply drop their current POS provider whenever they please, especially when that provider has access to all consumer and purchaser data. It’ll be quicker and cheaper to acquire an already established firm with strong customer loyalty.

Conclusion

With many catalysts on the horizon, now seems like the perfect time to own an excellent business at a more than fair price. If you believe marijuana will be decriminalized in the next few years, this looks like one of the few +EV bets in the market to take advantage of. I think I’ve used conservative estimates in all cases to express how little the company needs to execute for the stock to appreciate. In a world where favorable legislation passes and the company continues their rate of growth and executes on all targets, the stock can be worth many many bags of the current price in 2-4 years.

Very informational.

🔥🔥🔥